Case Study

Project

About the Client

The client is a renowned housing finance agency that holds more than three decades of experience in the financing industry. With 75 offices across the country, their areas of expertise include- home loans, PMAY, and non-housing loans.

-

Location: India

Industry: Housing Finance

Project Introduction

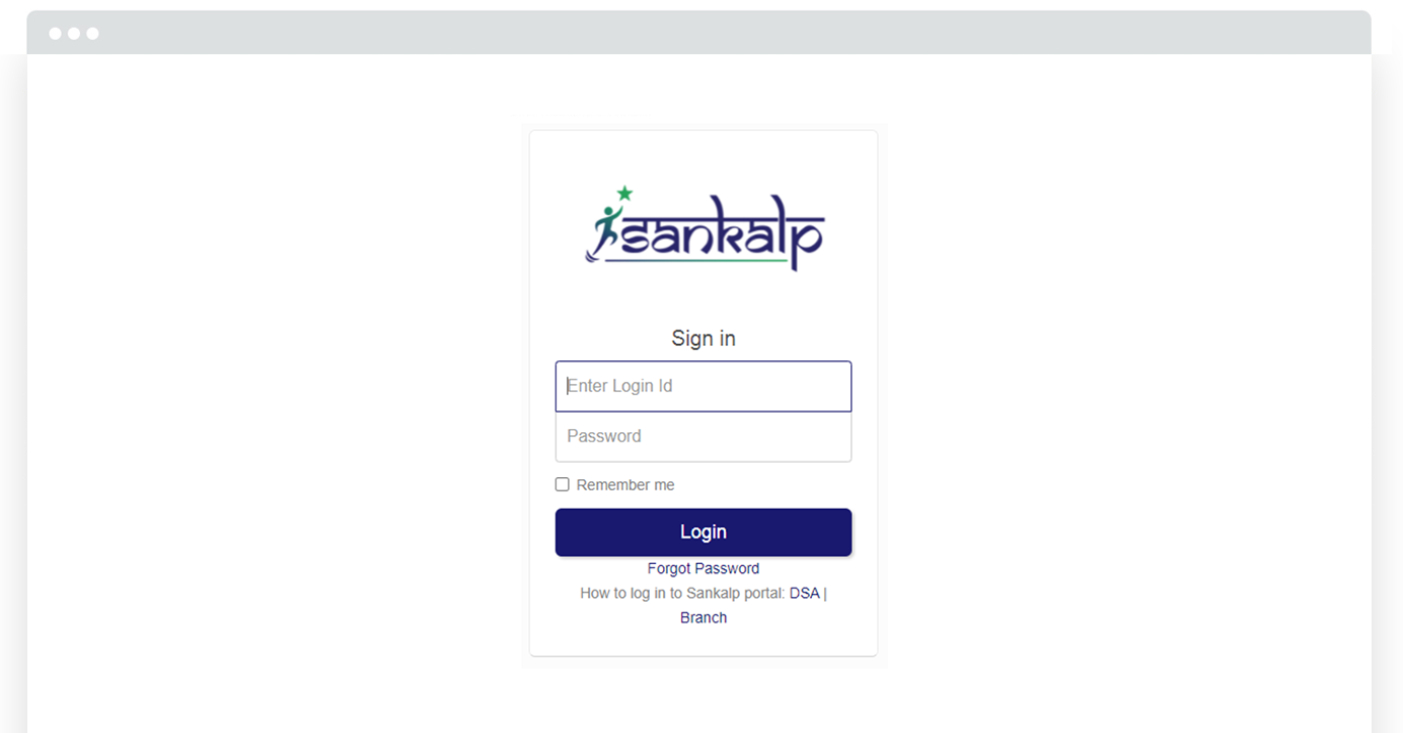

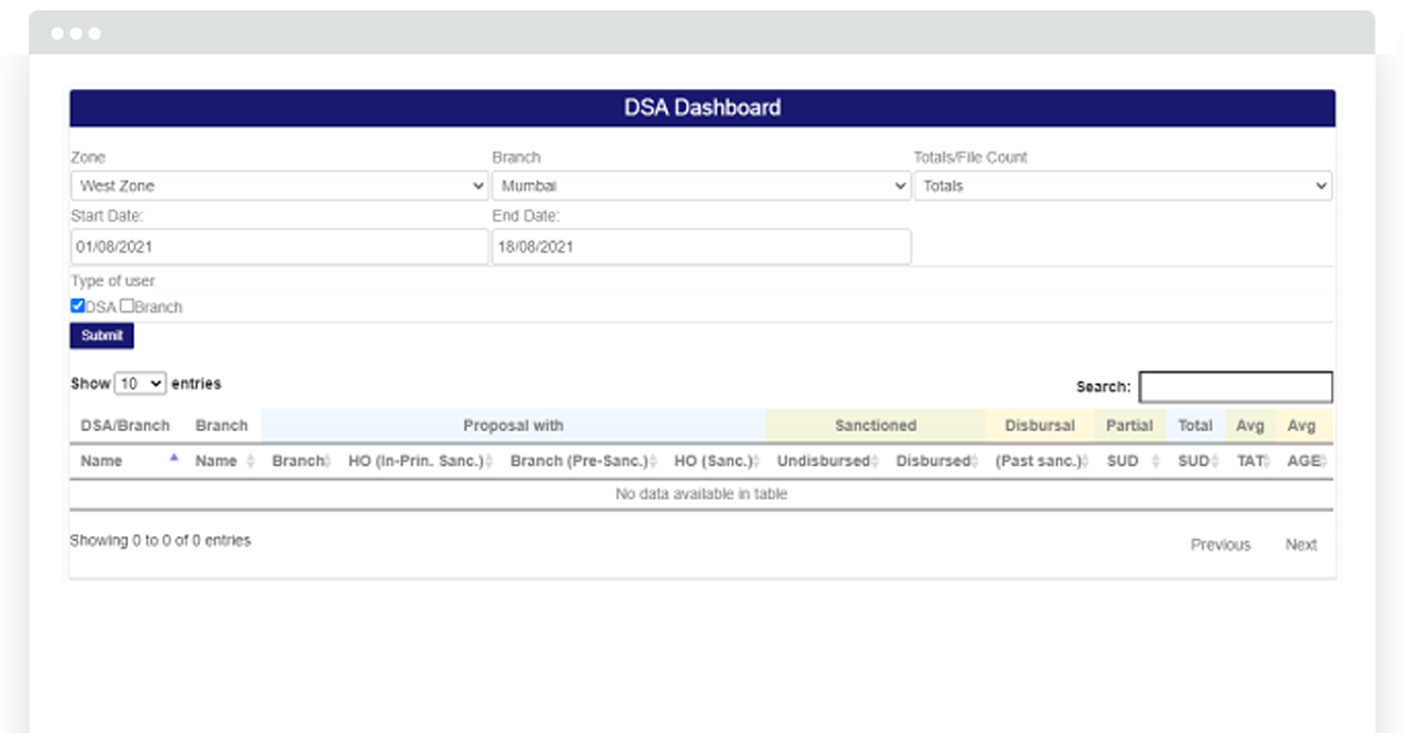

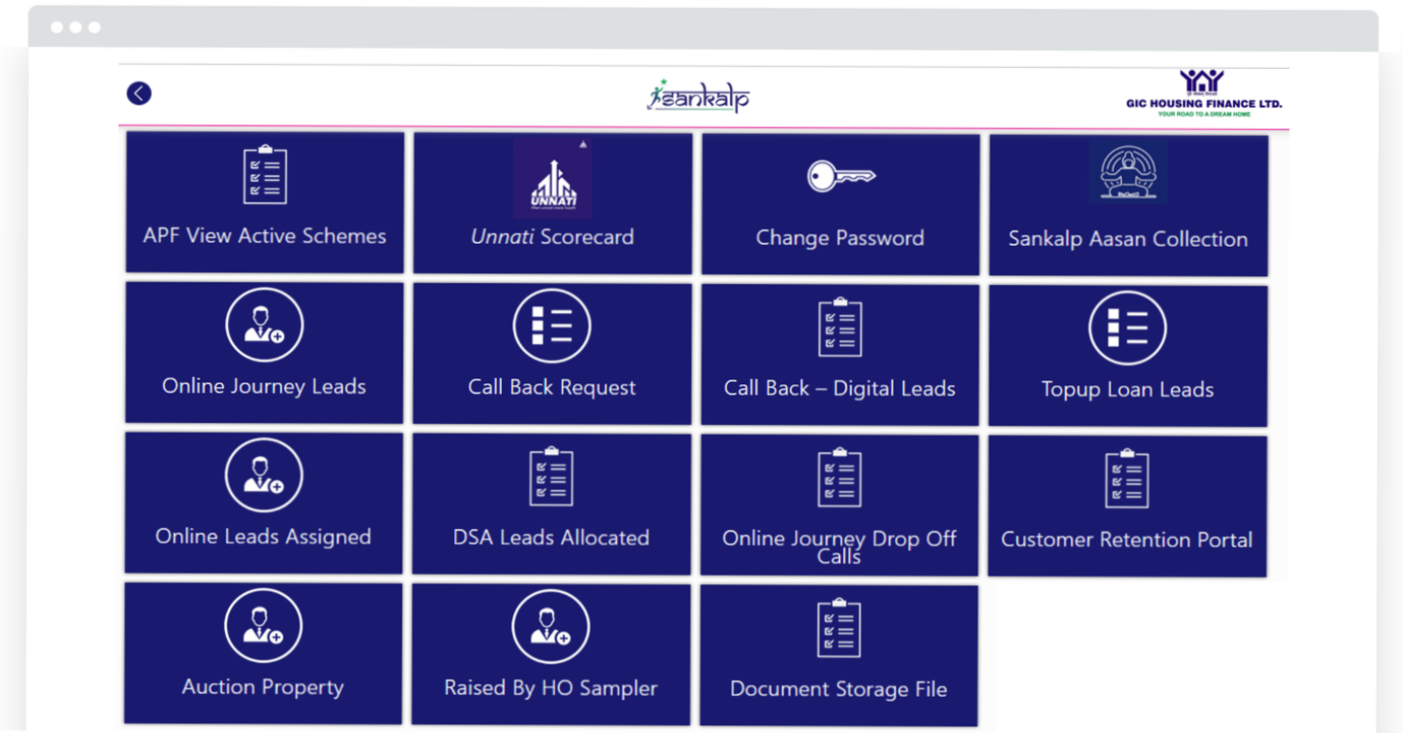

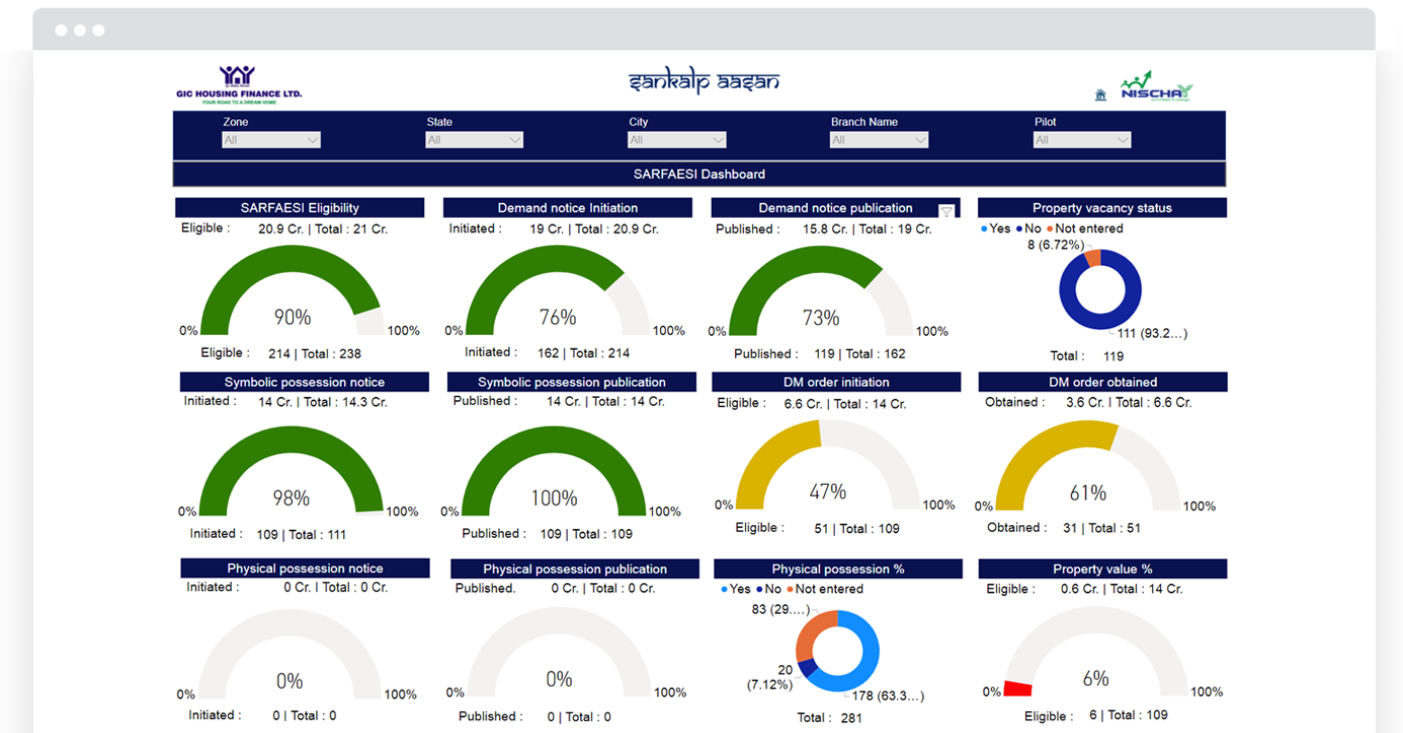

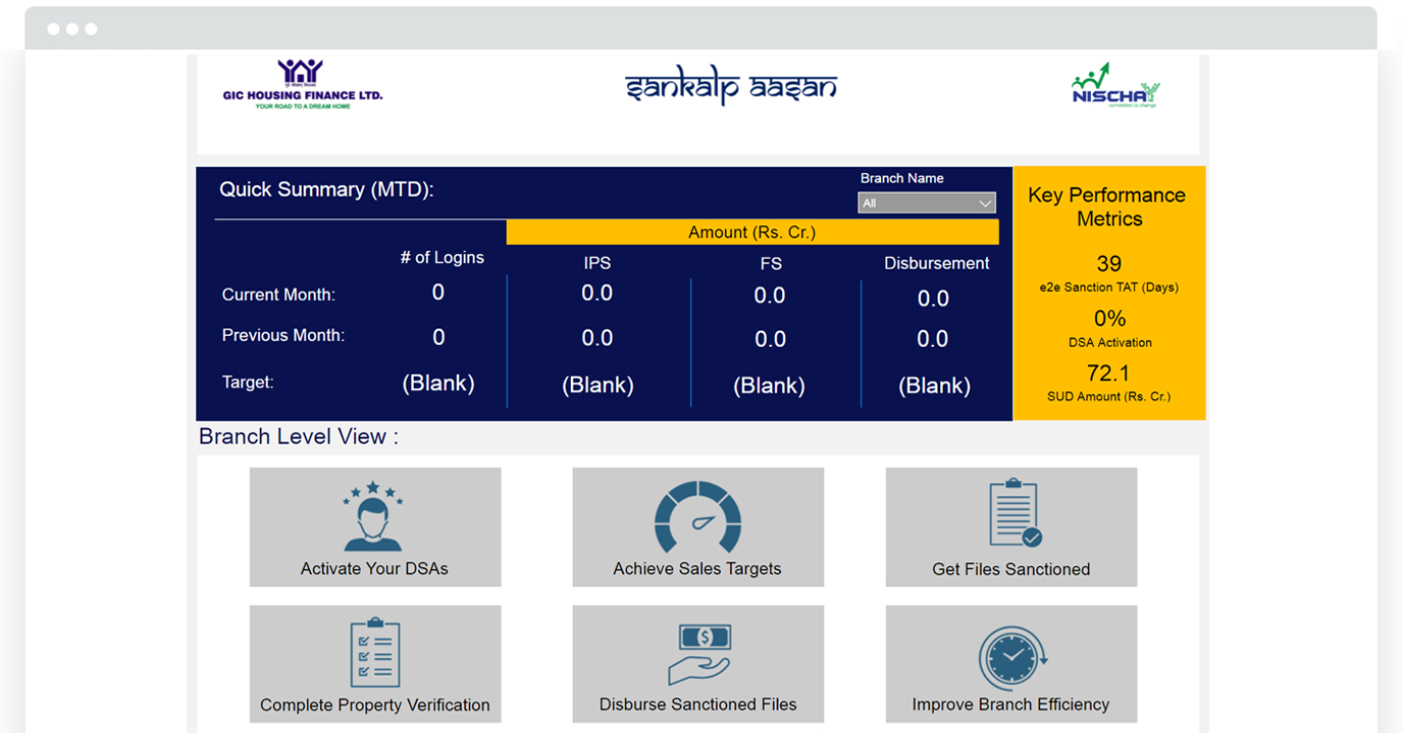

Sankalp is a ‘Housing Loan’ process system that streamlines and manages loan processing in a systematically defined order and delivers strategic reports via an intuitive web portal. It is also a modern-age web portal backed by multi-user functionality and has the provision for the branches and users (DSA) to submit loan file entries.

-

Type: Web Portal

Team Size: 8

Project Duration: 12 Months

Business Objective

The client wanted to establish a digital platform where the entire loan lifecycle is automated and which delights their customers with the experience of online loan application processing. The prime emphasis of the client was on minimizing the paperwork and manual processing.

Solution Offered

-

Automated loan

lifecycle -

Online

loan application -

Real-time SMS/email

notifications of

file status -

Fraud control

unit

For Clients

- Multiple user-based access

- Loan application entries (H.O/Branch/Telecallers)

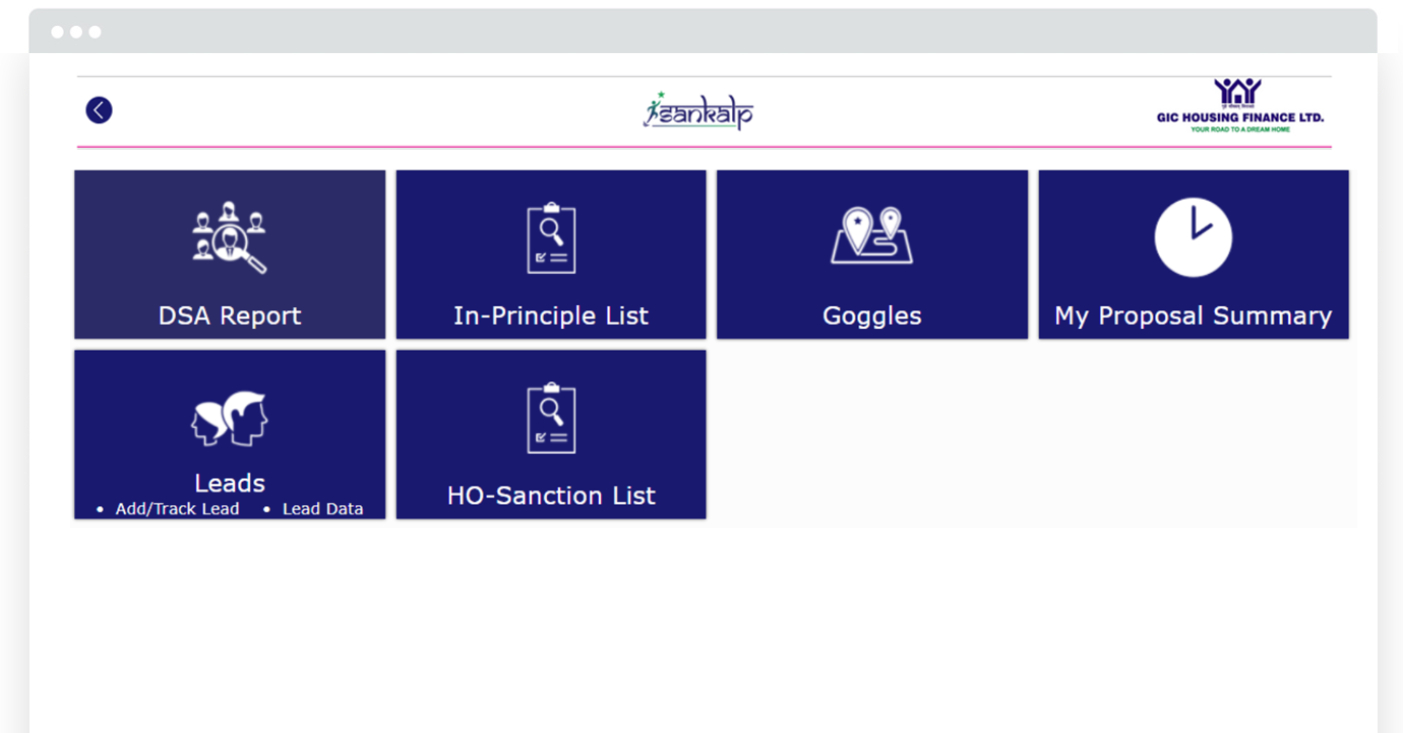

- Lead management & tracking (Goggles)

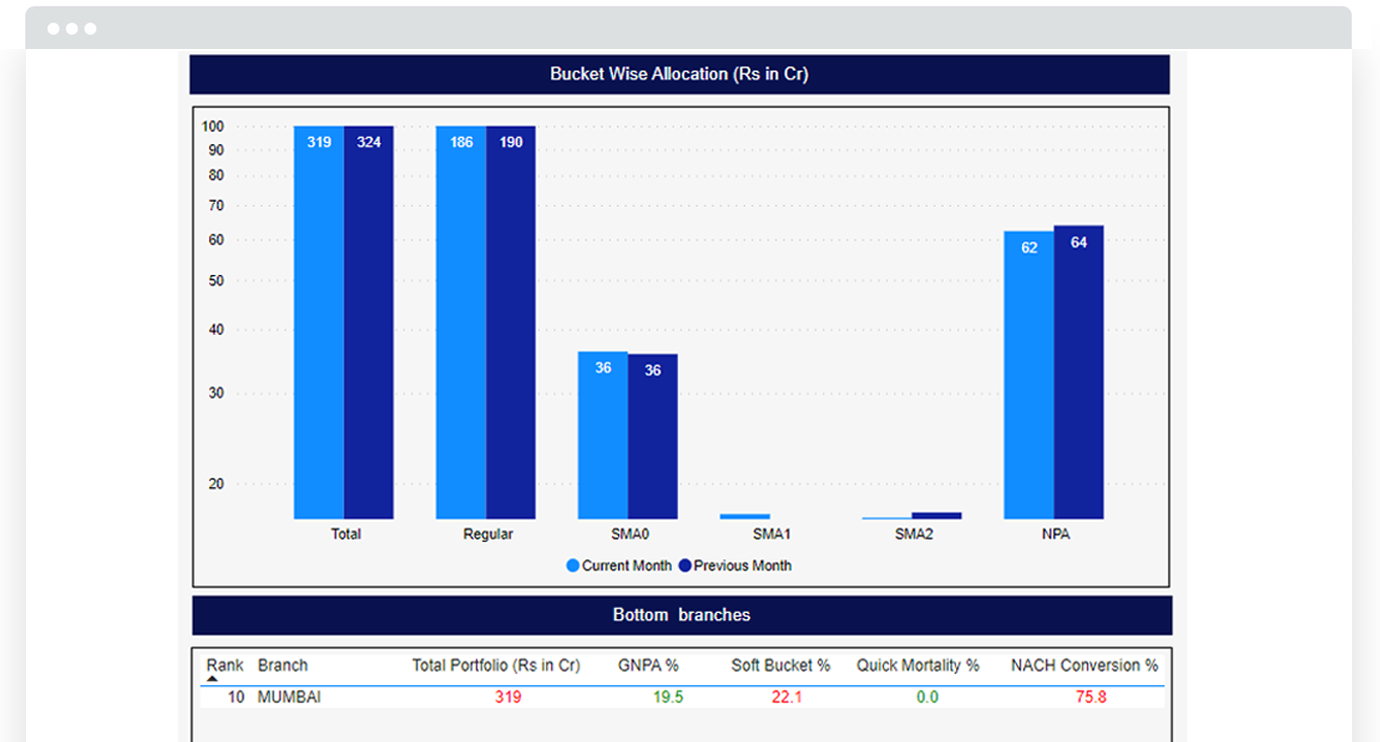

- Real-time reports & sales funnel metrics

- Notifications and alerts

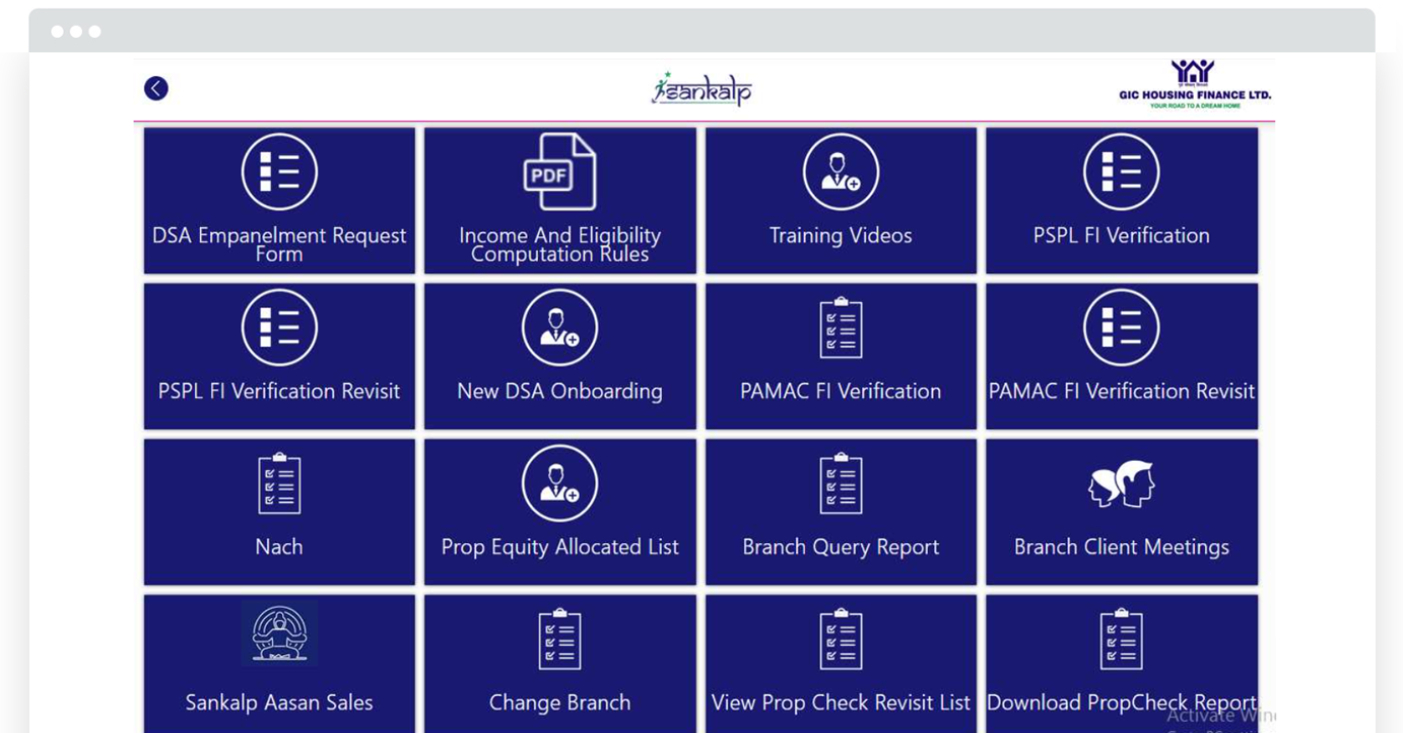

- PSPL FI & PAMAC FI verification

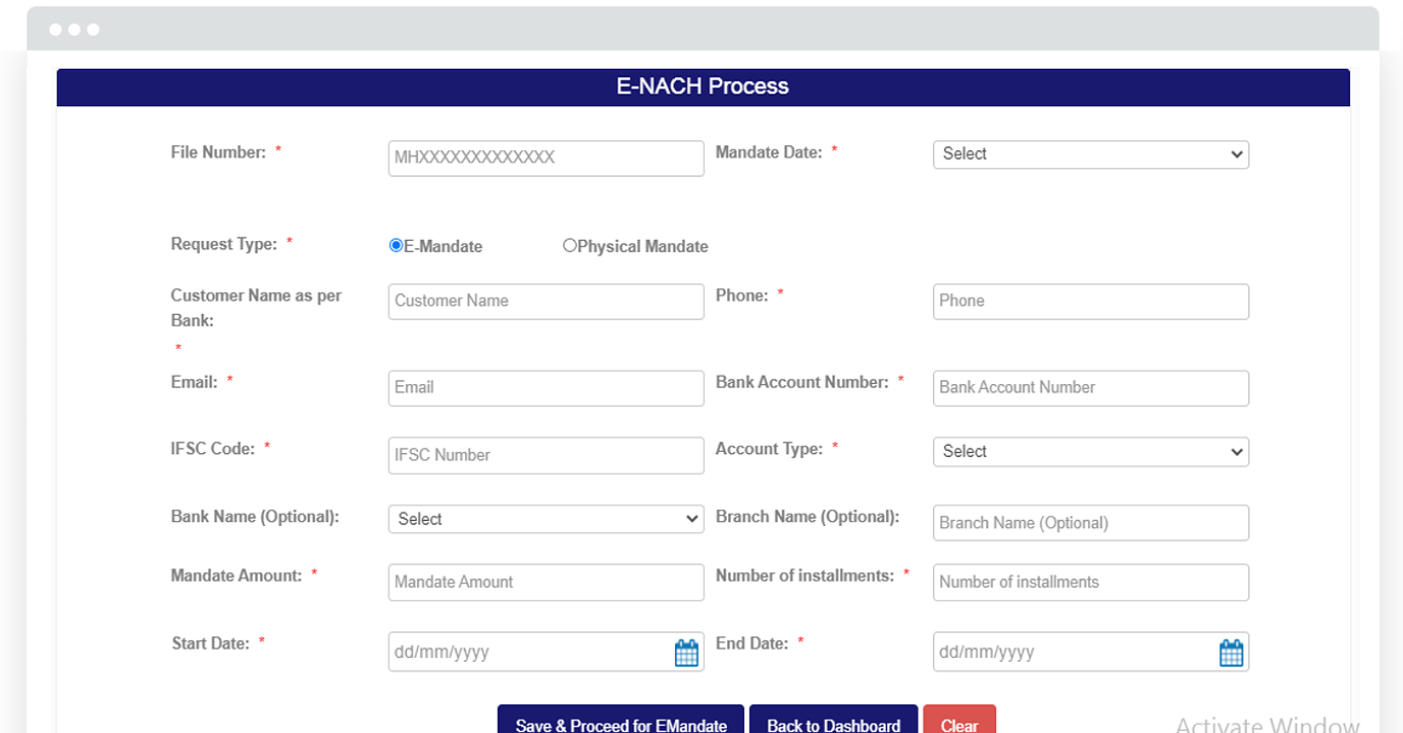

- Nach- Mandate creation, validation, registration & UMRN generation

- Sankalp aasan sales

- Customer retention portal

- Fraud control unit

For GIC Users

- Check loan eligibility

- Multiple payment modes

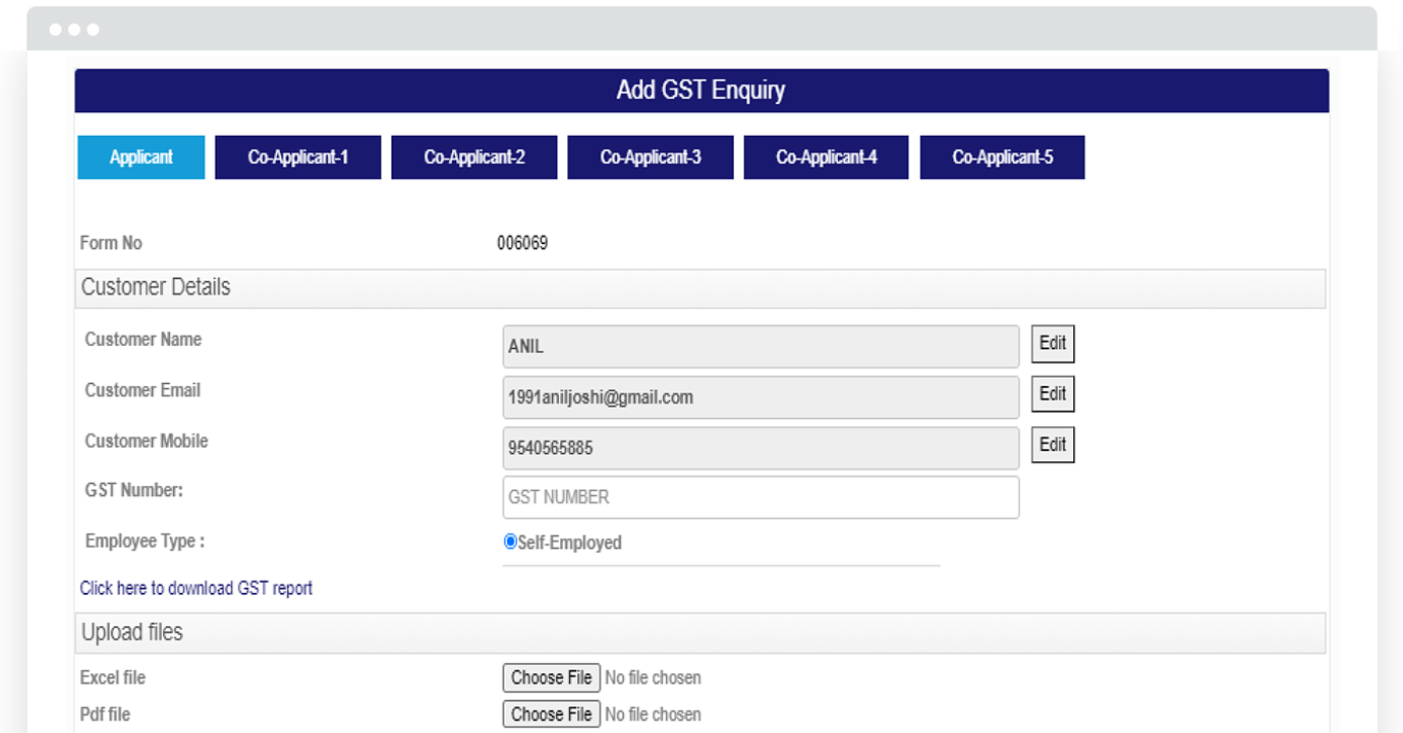

- Upload documents and storage

- Real-time SMS/email alerts

- APF view active schemes

- Unnati scorecard

- Sankalp aasan collection

- Online journey leads & topup loan leads

- Fetch ITR detail reports & CIBIL details

- Get referral benefits

- Fetch CIBIL details (CIBIL score) for any customer

- Analyze the income of any customer and fetch detailed reports from the system

- Apply for a loan online and upload documents easily

- Fetch the ITR detail reports from the system

- Make online payment with status

- Multiple users can access the website

- Check loan eligibility

- Get referral benefits